A Look Into The Markets

Happy Thanksgiving to you and yours. With all financial markets closed on Thursday for the Thanksgiving Holiday, this week's shortened edition will focus entirely on interest rates.

History of Thanksgiving

Sarah Joseph Hale campaigned for a national Thanksgiving in the United States during the 19th century, eventually winning President Abraham Lincoln's support in 1863. He and subsequent presidents proclaimed a National Day of Thanksgiving annually for the last Thursday in November. In 1870, Congress passed legislation making Thanksgiving (along with Christmas Day, New Year's Day, and Independence Day) a national holiday. On December 26, 1941, President Roosevelt issued a proclamation designating the fourth Thursday in November (which is not always the last Thursday) as Thanksgiving Day.

The Where, Why and What's Next for Rates

Where are rates headed?

Near term it is lower. The Thanksgiving holiday appeared to come a week or so early from an interest rate perspective as home loan rates have declined to the lowest level in over two months.

The decline in interest rates is not limited to long-term interest rates, like mortgages. Short-term interest rates have also declined and the financial markets are pricing in no more rate hikes. In a reminder of how fast markets can change, there is currently a chance the Fed cuts rates as soon as March 2024.

Why?

The economic news of late has been "bond-friendly". Inflation has started to ease; unemployment is ticking higher and reports on the economy show continued softening. In addition to weaker economic news, the geopolitical landscape carries a lot of risk with fears of tensions in the Middle East escalating. We are also seeing recession fears escalate around the globe. Add it all together and it likely means the Fed has finished hiking rates, with the peak or terminal rate achieved in July.

What's Next?

Next week we will get the Fed's favored gauge of inflation, the Core Personal Consumption Expenditure (PCE) Index. Expectations are for the annualized inflation rate to come in at 3.7%. When the Fed says they are holding rates higher for longer until inflation hits 2.00%, the Core PCE is what they are talking about. If the readings come in hotter than expected, rates could suffer. The opposite is true.

We also have some Treasury auctions, where the US sells debt to fund our government. After the recent decline in rates, the 10-yr Note has moved from 5.00% to 4.40%. The markets will be looking at the buying appetite after a decline in rates. If investor demand is tepid, the Treasury Department may have to increase yields (offer higher interest rates) to sell all the debt.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

The good news? You can see how bonds have broken off a down escalator with rates moving higher over time. It now appears as though rates are at the beginning stages of creating an up escalator where rates move sideways to lower over time. The forthcoming news and confirmation that inflation is moving lower will decide whether a new trend of lower rates emerges.

Chart: Fannie Mae 30-Year 6.5% Coupon (Friday, November 24, 2023)

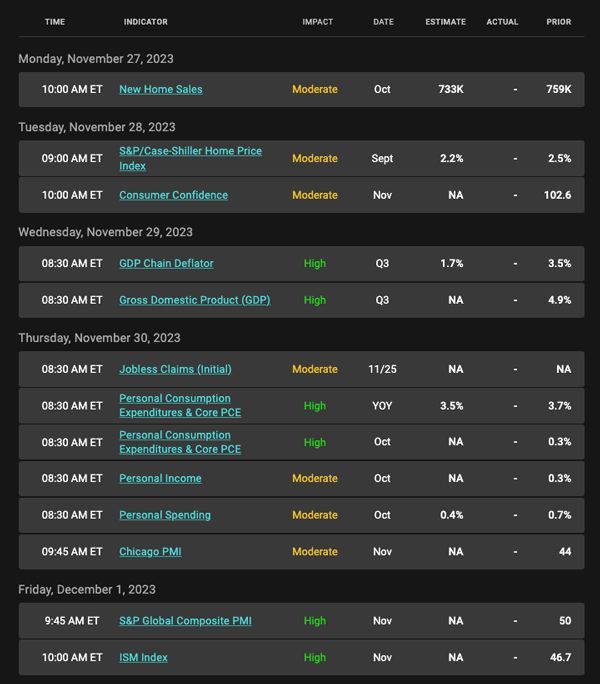

Economic Calendar for the Week of November 27 - December 1

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.