A Look Into the Markets

This past week interest rates held near the best levels in two months in response to bond-friendly news. Let's review what happened last week and look at what to watch for this coming week.

"She says, Let's go" - Let's Go by the Cars

Inflation is Declining

Disinflation, or the rate of inflation declining, is in full bloom. The Consumer Price Index was reported on Tuesday and showed the rate of inflation continues to decline. This is great news. The Federal Reserve's dual mandate is to promote maximum employment and maintain price stability. They want to see unemployment start to rise and prices start to fall. On the former, the last jobs report did show the labor market showing signs of cracking. Now, we are seeing consumer prices start to drift lower.

The takeaway? It likely means the Federal Reserve has finished hiking rates. It also means the last rate hike was back in July. This is also important because when the Fed says, "higher for longer", we must remind ourselves that the clock starts ticking in July as to when we will see a rate cut. Fed Fund Futures are currently pricing in a small possibility as early as next March.

Don't Tell the Fed

Despite a rash of economic news, suggesting that the Federal Reserve should be finished hiking rates - don't tell the Federal Reserve that. Fed officials were out in full glory, suggesting that the Fed may not be done with hiking rates yet. Why would they say such a thing when the data suggests that economic conditions are moving in the right direction for the Federal Reserve to pause? Likely, they do not want to take a victory lap.

Inflation is coming down, the labor market is indeed starting to loosen, and the economy is slowing. This is what the Fed wants to see and the rally we have seen in both stocks and bonds supports the likelihood that the next Fed move will be a rate cut.

Shorts Get Scorched

Markets are made with people on both sides. There are those betting on higher prices, and the other side betting on lower prices. Over the last several months, there has been rising short interest in the bond market. This means many people are betting on higher rates.

Well, as you can imagine over the past couple of weeks with interest rates improving, folks betting on higher rates, really got hurt. What the rising short interest has also done, is exaggerate and quicken the pace at which interest rates have improved from the peaks of this year. In the matter of just a couple of weeks, we watched the 10-year note move from 5% to under 4.50%.

What to watch for? Data or news that gives those betting on higher rates, a reason to celebrate. Any unfriendly bond news could quickly erode the nice rate relief we have experienced.

Bottom line: It appears that the Federal Reserve has finished hiking rates, and the peak in long-term rates is in. If you or someone you know is interested in buying a home now would be an incredible time, because if rates continue to drift lower it is going to attract more buyers and increase competition.

Looking ahead

There are a host of economic reports that can move the financial markets, but what may move the market even more? Treasury auctions. Our rising debt must continue to be sold in the Treasury markets. After the recent decline in interest rates, will investors buy the bonds at current rates, or will the Treasury have to issue higher yields/interest rates to entice buyers? We shall see.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

On the far-right side of the chart, you can see how prices have broken to the upside out of the downtrend, which highlights the recent rate relief. If prices can close above $101 and the 10-yr Note can move sharply beneath 4.50% then rate relief will likely continue. The opposite is true.

Chart: Fannie Mae 30-Year 6.5% Coupon (Friday, November 17, 2023)

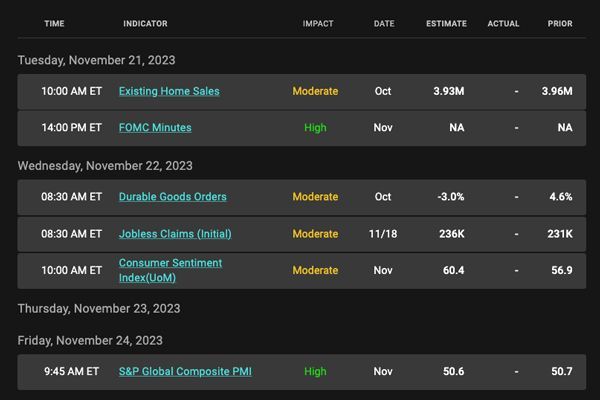

Economic Calendar for the Week of November 20 - 24

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.