A Look Into The Markets

Home loan rates continued their decline which started at the beginning of November. Let's look at what happened this past week and prepare for the big news ahead.

"Closing time, every new beginning. Comes from some other beginning's end, yeah" Closing Time by Semisonic.

Bonds Enjoy the Best Month in Forty Years

So how good has the bond market been in November? According to Bloomberg's widely followed U.S. Aggregate Bond Index, the 4.3% gain in November was the largest since 1985. During the month, we have watched the 10-yr Note, which ebbs and flows with mortgage rates, move from 5.00% down to 4.25%.

Sensing the Fed is Finished

If the decline in inflation continues "for several more months ... three months, four months, five months ... we could start lowering the policy rate just because inflation is lower," Fed Governor Christopher Waller.

Likely the biggest driver of interest rates over the past couple of weeks is the idea that the Federal Reserve has finished hiking rates. Fed Governor Waller, quoted above, is one of several Fed officials suggesting the Fed's next move could indeed be a rate cut.

Bill Ackman, CEO of Pershing Square, who shook the markets in late October when he said he covered his bet against higher rates, recently suggested that the federal reserve may need to cut rates aggressively in the first quarter of 2024 to avoid a hard economic landing. It is worth noting that he is alone on that consensus, but he was also alone last month when he said Treasuries yielding 5% is too high in this risky world.

If the Fed is indeed done hiking rates, it means the last rate hike was in July and, that is when the clock starts as it relates to when a rate cut would happen. For reference, over the last four rate hiking cycles in the past 30 years, the Fed cut rates on average of 8.65 months after the last hike. So, if history is any guide, the Fed would cut rates by their April 30th /May 1st, 2024 meeting.

GDP Was Not Gross, Markets Move On

The second reading of our 3rd Quarter gross domestic product (GDP) was reported at a robust 5.2% from a previous reading of 4.9%. Normally, such a strong reading would mean higher rates, and possibly more Fed Rate hike activity. But the markets are forward looking, and it is widely expected that the fourth-quarter GDP will reside somewhere near 2%, a sizable decline from the current rate. Moreover, the GDP number was bloated because of excess government spending, which is unsustainable. Bottom line, the economy is growing, but it is not overheating, and does not require more Fed hikes.

Inflation Continues to Decline

The Fed's favored gauge of inflation, the Core Personal Consumption Expenditure (PCE) index, came in at 3.5% year-over-year, the lowest level in a couple of years. It remains well above the Fed's target of 2%, but it is headed in the right direction which is lower. This is yet another data point to allow the Fed to pause hiking rates and let the series of hikes over the last couple of years further set into the economy.

Bottom line: It appears that the Federal Reserve has finished hiking rates, and the peak in long-term rates is in. If you or someone you know is interested in buying a home now would be an incredible time, because if rates continue to drift lower it is going to attract more buyers and increase competition.

Looking Ahead

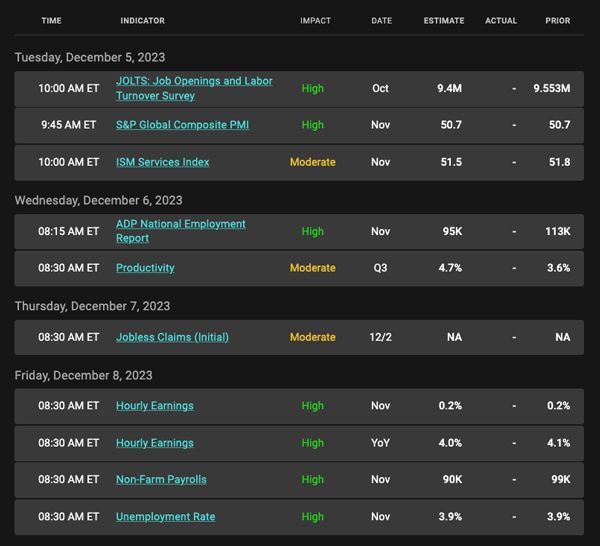

Next week we will see important readings on the labor market, including the ADP Report, Jolts Report, and the November Jobs Report. If the readings continue to show signs the labor market is cooling and unemployment is rising, it's likely and a good bet that the Fed is done hiking rates. There will also be Fed speakers out sharing their opinions on the economy and interest rates. All of this could determine whether rates will improve further in the near-term.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

On the far-right side of the chart, you can see how prices have broken to the upside out of the downtrend, which highlights the recent rate relief. If prices can close above $102 and the 10-yr Note can move sharply beneath 4.35%, the rate relief will likely continue. The opposite is true.

Chart: Fannie Mae 30-Year 6.5% Coupon (Friday, December 1, 2023)

Economic Calendar for the Week of December 4 - December 8

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.