A Look Into the Markets

Home loan rates have improved once again finishing the year at the best levels since May. Let’s look at what happened in the final trading week of the year and discuss what to watch as the new year begins.

"May we all have a vision now and then. Of a world where every neighbor is a friend" Happy New Year by ABBA

3.83%

The 10-year Note continues to hover near 3.83%, exactly where 2023 began. But as we all know, this is an enormous improvement in rates. In just the last nine weeks, the 10-year note declined from 5.11% to current levels.

The two-month decline in Treasury yields is the largest since 2008, when the Federal Reserve was aggressively cutting rates.

This decline in Treasury rates have helped mortgage rates immensely. In late October, 30-year mortgage rates went from 8% to something in the 6’s. That is amazing relief!

Why the Improvement and Rates?

Rates around the globe are declining. Countries like Germany and the UK are watching their government bond rates slide lower as their economies are in poor shape. The German 10-year bund is at the lowest yields since late 2022. As rates around the globe move lower, so do rates here in the States.

Yet, our rates have not improved as much as others around the globe. Why? Our economy, while slowing, is performing far better than others around the globe. Additionally, our unprecedented amount of deficit spending is applying upward pressure on interest rates, so yes, rates have improved, but not as much as other countries around the globe.

Fed Rate Cuts in 2024

Entering 2023 interest rates were in a similar position, but in 2023 the Fed hiked rates multiple times through July. In 2024, it is widely expected that the Fed will start cutting rates. There is a difference of opinion, as to how many rate cuts we will see. The Fed, who is a very bad forecaster on the economy, inflation and interest rates, is suggesting they will only cut rates three times. However, the Fed Funds

Futures market which prices in the probability of Fed hikes/cuts is currently pricing in as many as six rate cuts.

This is a big difference between what the Federal reserve is thinking and what the markets are thinking. Incoming data will decide when and how much the Fed cuts rates. It is an election year and history has shown the Fed is more likely to cut rates sooner rather than later.

Again, if history is any gauge, the first rate cut comes about eight months after the last hike setting us up for a cut by April.

Looking ahead

The Big news may not come from the economic calendar, but from the turning of the calendar itself. Every year we see a lot of volatility in stocks and bonds as institutions and traders take positions and place bets. Last year we watched the 10-year Note go from 3.83% to 3:20% in January. Who knows what will happen this year, but we should expect a sharp move one way or the other.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

On the far right side of the chart, you can see how prices continue to move sideways to higher over time - meaning lower rates over time. We may very well find out in this first week of January if this great trend will continue.

Chart: Fannie Mae 30-Year 6.5% Coupon (Friday, December 29, 2023)

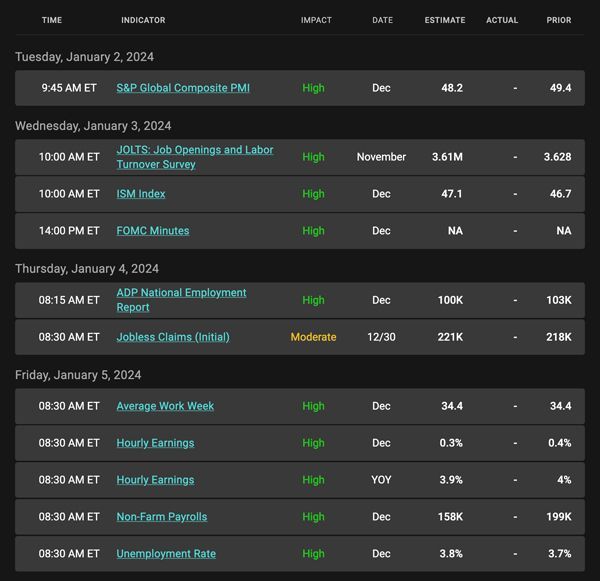

Economic Calendar for the Week of December 25 - 29

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.