A Look Into The Markets

As the first half of 2024 draws to a close, let's discuss what happened in the mortgage and housing markets, and what to watch for in the week ahead.

"I said that time may change me. But I can't trace time" Changes by David Bowie.

Inflation Remains a Concern Around the Globe

Two years and seven months after Fed Chair Powell admitted that high inflation was not "transitory", we are still dealing with the threat of higher inflation here and abroad.

Last week, both Canada and Australia reported hotter-than-expected inflation readings. And in both cases, it was met with a Central Bank rate cut chances fading. In the case of Australia, that country is likely to continue hiking rates. The bond market is global so if inflation and rates stay higher globally, it puts upward pressure on our rates at home. This story was the main reason for our spike in mortgage rates this week.

Here at home, numerous Fed officials have been very clear about their position on inflation in the U.S. They all sense that it will persist and likely rise above current levels through the end of the year. At the recent Fed Meeting, the Federal Reserve forecasted inflation to bottom out this month with no further moderation for the year. And because of this, they do not see any meaningful moderation in interest rates, hence their forecast of just one Fed rate cut later this year.

Housing Sales Slow

Existing and New Home Sales reports were weak in response to continued high mortgage rates. In the case of existing homes, prices continue to climb nationally, but at a slower and healthier pace. We are also seeing inventory continue to grow for the first time in a while. If these developments persist, it will put existing home sales housing in better balance going forward.

In the case of new homes, the current sales rate has elevated inventory to a historically high 9.3-month number. New home builders are being challenged. Here's what National Association of Home Builders Chairman, Carl Harris had to say about the weak new home sales reading and challenge for builders.

"Persistently high mortgage rates are keeping many prospective buyers on the sideline. Home builders are also dealing with higher rates for construction and development loans, chronic labor shortages, and a dearth of buildable lots."

Japanese Problems can be U.S. Problems

This past week, the Japanese Yen fell to a four-decade low versus the U.S. Dollar. This is happening as the country attempts to normalize its monetary policy after decades of the government controlling interest rates and holding them at or below 0.0 % for many years. The Japanese Government's 10-year bond rose over one percent for the first time in 13 years on Wednesday.

This story is worth following as Japan is the largest holder of U.S. Treasury debt, with over $1T of Treasuries. There is some chatter in the financial markets that if the Yen continues to weaken against the U.S. Dollar, Japan may be forced to sell some of its enormous Treasury holdings and use those proceeds to buy the Yen to keep it from continuing to decline against the U.S. Dollar.

If Japan were to start selling U.S. Treasuries, it would create downward price pressure and upward rate pressure.

4.35%

Despite the increase in rates, the 10-yr Note yield remained beneath an important ceiling of resistance at 4.35% which stemmed the spike higher. Watch that level moving forward.

Bottom line: There appears to be little path for rate relief in the near term in the face of higher inflation threats. Of course, this story can and will change. Fed Chair Powell said if they see "unexpected weakness" in the labor market, they will likely have to change their position on interest rates and cut sooner and more often than currently expected.

Looking ahead

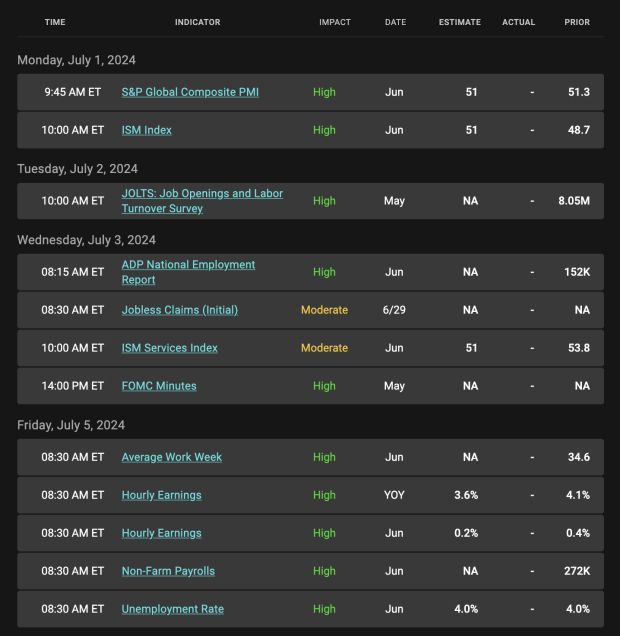

Next week is a short one as we celebrate Independence Day on Thursday, July 4th. However, the economic calendar is filled with potential fireworks, including the Minutes from the last Fed Meeting and the important Jobs Report. As we shared above, if we see a surprise weakness in the labor market, the Fed could change its current "higher for longer" rate position and cut rates sooner. Some on Wall Street are betting this is going to happen.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices moved lower throughout the week but held steady (last Green candle) as the 10-yr Note yield pushed lower from 4.35%

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, June 28, 2024)

Economic Calendar for the Week of July 1-4

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.