A Look Into The Markets

Independence Day in the United States, celebrated on July 4th, marks the anniversary of adopting the Declaration of Independence in 1776. This historic document, primarily authored by Thomas Jefferson, declared the thirteen American colonies free from British rule. The decision came after years of escalating tensions and conflict with Great Britain, culminating in the Revolutionary War. The first celebrations of Independence Day included fireworks, parades, and public readings of the Declaration, a tradition that continues to this day, symbolizing the enduring spirit of freedom and democracy.

As we celebrated Independence Day yesterday and throughout the weekend, let us take a moment to reflect on the sacrifices and bravery of those who fought for our freedom. It's a day to honor our nation's history and the values of liberty and justice that continue to guide us. Enjoy the festivities with your loved ones, whether watching fireworks, participating in parades, or having a family barbecue. Let's cherish our freedoms and come together in the spirit of unity and patriotism.

"My Country 'Tis of Thee" by Henry Carey

Home Loan Rates Improve to Finish the 1st Half of 2024

According to Freddie Mac, 30-year fixed mortgage rates finished the week of June 26th at 6.86%, and the best levels since early April. This rate improvement was fueled by weak economic news here and abroad, moderating inflation, global uncertainty, and expectations of a Fed rate cut.

As we move through the second half of 2024, we will continue to watch important inflation and labor market readings. These readings will determine when the Federal Reserve cuts interest rates. Two new themes to watch in the coming months will be oil prices and the Presidential election. Oil recently touched $84 per barrel; a sizable increase from the $73 seen just one month ago. Oil makes up a large portion of headline inflation, so if oil prices remain elevated, it elevates inflation which could delay a Fed rate cut.

Over time oil prices ebb and flow along with 30-yr Fixed mortgage rates. If oil moves higher, rates tend to go higher. The opposite is true.

As it relates to the Presidential election, we should expect uncertainty. Bonds and interest rates typically thrive in an uncertain environment. We shall see.

Looking ahead

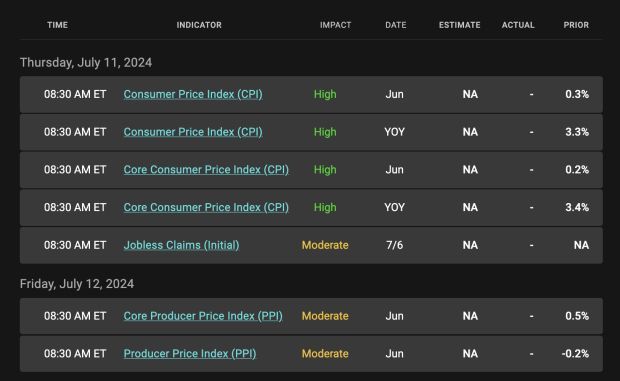

Next week brings the important Consumer Price Index (CPI). As we shared above, oil has risen sharply since the first week of June. If the reading comes in higher than expected, bonds and rates could be spooked. The opposite is true.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices are trying to bounce off the $100 level. This Friday's Jobs Report and next week's CPI could determine the next directional move for bonds.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, July 5th, 2024)

Economic Calendar for the Week of July 8-12

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.