A Look Into The Markets

This past week interest rates touched the highest levels in decades. Let's discuss what happened and see what to watch for as the 4th Quarter begins.

"

Oh, oh, oh, shake it up, just like bad medicine. There ain't no doctor that can cure my disease" - Bad Medicine by Bon Jovi

Ouch

The U.S. bond market has been struggling since April, continuing a disturbing pattern of higher rates over time. Despite market expectations and even the Federal Reserve saying rate hikes are nearing the end, rates continue to tick higher. Why?

A big reason is oil. It is not a coincidence that interest rates and oil hit 2023 highs on the same day this past week. Higher oil leads to inflationary pressures and counters the Fed's efforts of lowering inflation to their 2% target. Oil hit $94 a barrel on Thursday, in response to lower-than-expected oil stockpiles in Cushing Oklahoma.

Another big reason for the continued rise in rates is debt. Back in July, the Treasury Department requested an additional $275 billion to fund the government between August and September. This action led to a downgrade of U.S. debt. This week, Moody's rating firm said that a government shutdown would likely lead to an additional credit downgrade. Like any consumer with high debt problems and the ability to repay being questioned, they pay a higher rate. We are seeing that play out in the U.S. Treasury market as the 10-yr Note yield hit 4.69%...the highest since 2007.

Housing Impact

Despite interest rates hitting the highest levels in decades, home prices remain elevated. This is largely due to a lack of available inventory. Should inventory increase, it would likely lead to home prices returning some of the frothy price appreciation achieved during the pandemic. New construction was filling some of the inventory void of late as home builders took advantage of an incredible opportunity to fill robust housing demand by offering incentives to offset the climb in interest rates. But with interest rates moving another leg higher, it has made it tough for homebuilders to come up with enough incentives to offset the uptick in interest rates.

Last Thursday, Pending Home Sales for August declined sharply, and the National Association of Realtors Chief Economist had this to share: "Mortgage rates have been rising above 7% since August, which has diminished the pool of home buyers. Some would-be home buyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets."

Ironically, it is this sort of bad economic news that will lead to the Fed doing less and rates ultimately coming down.

Bottom line: Interest rates and oil touched 2023 highs at the same time. Housing will continue to struggle in the absence of rate relief, and it is this very struggle, which could lead to slower overall economic activity and thus lower rates.

Looking Ahead

Next week brings even more headline risk. Front and center will be whether the government can avoid a shutdown. If the government can make a deal, markets will be looking at how much new debt will be added and as we have shared, debt is a problem. From an economic standpoint, the Jobs Report on Friday is the main event.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

On the right side of the chart, you can see how prices are trying to remain near 2023 lows at $100. If the Bond can stay above this key level, we could see some stabilization and improvement, the opposite is true.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, September 29, 2023)

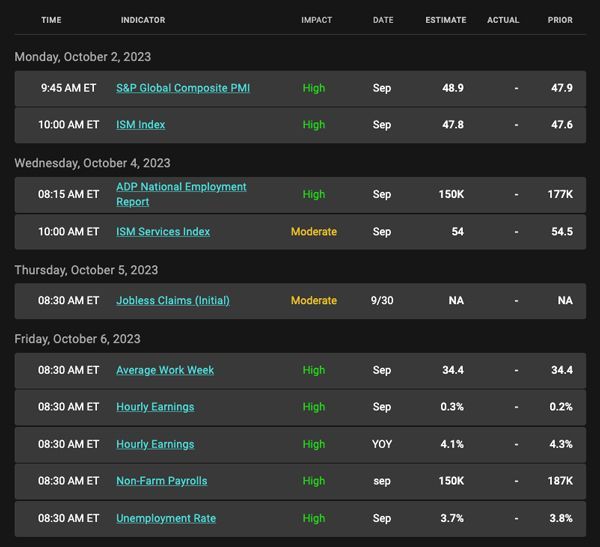

Economic Calendar for the Week of October 2 - 6

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.