A Look Into The Markets

It was another wild week in the financial markets with interest rates backing away from the highest levels in decades. Let's discuss what happened and look at the news to watch for this coming week.

"The tide is high but I'm holding on" The Tide is High by Blondie.

JOLTS Report Jolts The Markets

On Tuesday, the JOLTS report, which shows how many jobs are available, ticked up much higher than expectations. As a result, the knee-jerk reaction caused interest rates to spike to the highest levels in 16 years. Why? Fear that the labor market remains too tight, and the Fed will have to continue to hike rates and hold them higher for longer.

The market reaction seemed overdone as a look into the details showed that the number of people quitting and the number of people hiring continue to slow, suggesting that the labor market is cooling down to the Fed's liking.

Hump Day Surprise

The negative vibe in interest rates quickly changed by Wednesday morning when the ADP payroll report showed there were only 89,000 private job creations in September. This number was essentially half of expectations and the lowest reading in over 2 1/2 years. This report along with other weak economic data around the globe sent oil prices sharply lower. Oil goes lower on the perception of less demand from a global slowdown. This was all good news for bonds and rates which improved nicely on the bad economic news, and softer inflation fears which come with lower oil prices.

Fed Still Talking Tough

Despite recent weaker economic data of late and the run rate of inflation headed towards the Fed's target zone, Federal Reserve officials continue to talk about the need for more rate hikes and the idea of holding them higher for longer. With mortgage rates at multi-decade highs in response to rising Treasury yields, we are seeing a sharp slowdown in housing. But do not say that to Atlanta Fed President, Raphael Bostic who uttered this gem last week: "Rising long bond yields not having an excessive impact on the economy".

The financial markets are not buying all the tough Fed talk as the Fed Funds Futures market is currently pricing no more rate hikes.

Debt And Deficit Spending

Interest rates have ticked higher throughout the Summer as the U.S. Treasury Department demanded more money than previously expected to fund our government. This action led to a downgrade of our debt as Fitch Rating agency cited "fiscal deterioration."

It's not truly clear if interest rates are pricing in all this deficit spending or if rates will go higher still as our federal government requests more money to fund operations.

Bottom line: Bad news is good news as we've seen with ADP helping interest rates improve. On the other hand, our excessive debt is applying upward pressure on rates. With the Fed still talking tough and the trend of higher rates still intact, there's a lot to follow.

Looking Ahead

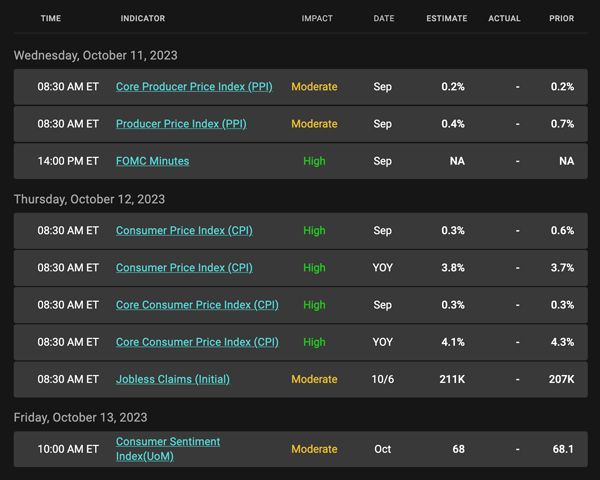

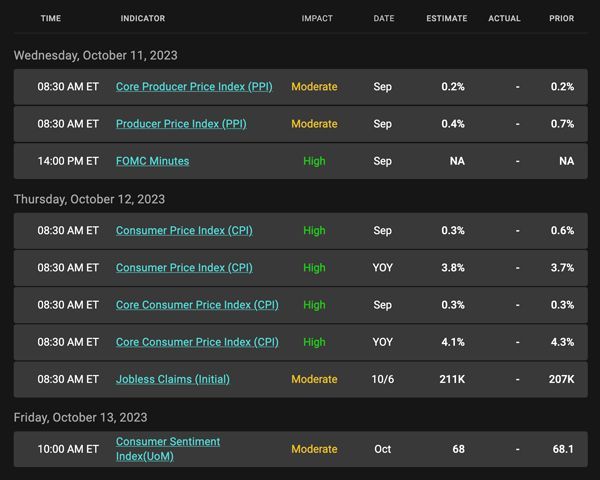

This coming week carries a bunch of headline risk with the Consumer Price Index (CPI) inflation reading, as well as the Producer Price Index and Consumer sentiment. Another potential market catalyst will be another boatload of Treasury supply. Will buyers demand more yield or higher rates to purchase these bonds? We shall see.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

On the far-right side of the chart, you can see how prices are trying to stabilize at 2023 price lows. A failure to hold at these levels will likely cause home loan rates to rise to another level.

Economic Calendar for the Week of October 9 - 13

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.