This week, rates touched the highest levels since Fall. Let's walk through three things that happened and what to watch in the week ahead.

"Don't speak, I know just what you're sayin', so please stop explainin', Don't tell me 'cause it hurts." - Don't Speak by No Doubts

1.) Fed Meeting Minutes Released

On Wednesday, the Minutes from the February 1st Fed Meeting were released. At that meeting, the Fed raised rates by .25% and in the following press conference, Fed Chair Powell said, "The disinflation process has started and that's a good thing." The smaller rate hike and disinflation reference were bond friendly at that time and led to the lowest rates since September.

Fast forward to today, the markets were on edge heading into the Minutes as we have since seen a surprisingly strong Jobs Report for January and a higher-than-expected inflation number, both of which lifted Fed rate hike expectations and mortgage rates.

The Fed Minutes ended up not mentioning disinflation whatsoever, but acknowledged prices have declined, but they need to see more progress (lower prices). Moreover, some Fed Members said there is an elevated threat of a recession in 2023. After the dust settled, rates remained elevated but stable.

2.) Inflation Rising Abroad

In Europe, Core inflation (ex food and energy) for January was revised higher to 5.3%. This now puts pressure on the European Central Bank to raise rates more aggressively like our Federal Reserve did last year with its string of .75% rate hikes. There is speculation the ECB will raise rates from the current 2.5% to 3.75% by September.

Why is this important to us? The bond market is global. If rates rise in other big bond markets like Europe, they increase here. The opposite is true. The markets will start watching to see if these economies slow materially because of the rate hikes. This would benefit long-term rates like mortgages. Currently, short-term rates are higher than long-term rates, which is generally a sign that economies are slowing, and the Fed must be careful not to hike rates too much and for too long.

3.) FHA Makes MIP Cut

The Department of Housing and Urban Development (HUD), through the Federal Housing Administration (FHA), announced a 30-basis point reduction to the annual mortgage insurance premiums (annual MIP) charged to homebuyers who obtain an FHA-insured mortgage. The premium will be reduced from 0.85% to 0.55% for most homebuyers seeking an FHA-insured mortgage, which could mean an estimated savings of $678 million for American families in aggregate by the end of 2023 alone. The reduction will benefit an estimated 850,000 borrowers over the coming year, saving these families an average of $800 annually.

Takeaway? This effort by the government to help with housing affordability should be applauded. This measure will help would-be homeowners.

Bottom line: We are revisiting the theme of 2022 where there was uncertainty and volatility about where inflation is headed, what the labor market will look like and what the Fed will do about it. Long-term rates still looked to have peaked, which is a good thing.

Looking Ahead

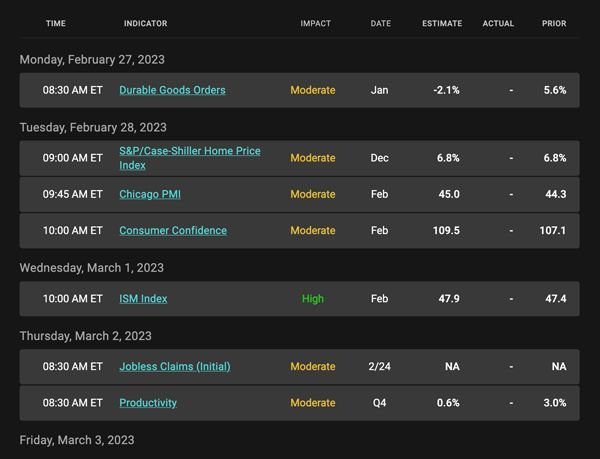

Next week brings the Case/Shiller Home Price Index, Consumer Confidence and Durable Orders. Durable Orders are items that last over three years, like a dryer or refrigerator. There will also be plenty of Fed speak and news from abroad which could move the markets.

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS prices fell beneath a key support level at $100. For rates to improve, we need to see rates climb above this important ceiling. The news and outlook for the economy will determine if and when this will happen.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, February 24, 2023)

Economic Calendar for the Week of February 27 - March 3

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.