Home loan rates held steady near the best levels in months after another decline in inflation. Let's look at what happened this week and brace for what is coming in the week ahead.

"Pump it up, Until you Can Feel it, Pump it Up, When you Don't Really need it" - Pump it Up by Elvis Costello.

December Consumer Price Index (CPI)

The headline Consumer Price Index, which includes food and energy prices, came in -0.1% for the month of December, which lowered the annual rate to 6.5%. The month-over-month decline was the first negative reading since December 2020.

Inflation is a main driver of long-term rates and is closely watched by the Fed, so seeing prices decline was a welcome sign for both.

The markets agreed. After the CPI report was released, the probability of a .25% rate hike on February 1st spiked to 87%. So, the markets are now expecting smaller and less Fed rate hikes.

Markets Are Forward Looking

The 10-yr Note yield, which does ebb and flow alongside mortgage rates, touched 3.46% after the report, the lowest level since early December. Long-term rates are forward looking and seeing where inflation is headed, which is lower. If inflation continues to decline, we should expect long-term rates like the 10-yr Note and mortgages, to decline as well.

Fed Jawboning Not Working Like 2022

Last year, home loan rates spiked higher and quickly in response to tough Fed talk or jawboning. So far this year, tough Fed talk is not having the same effect. Even though the Fed is currently saying they will keep rates higher for longer, long-term rates have ignored their words and continued to improve.

This is a reminder that long-term rates will only go higher if the economy can absorb all the rate hikes. The Treasury market is clearly saying the economy can't handle higher for longer rates without tipping into an economic recession. Like the famed investor, Jeffrey Gundlach, shared this week, "Watch Treasuries to follow Fed rate hikes and do not listen to the Fed".

Bottom line: 2023 has started with an improvement in rates, which is the opposite of what happened last year. With sellers eager to make deals, now is a great time for a buyer.

Looking Ahead

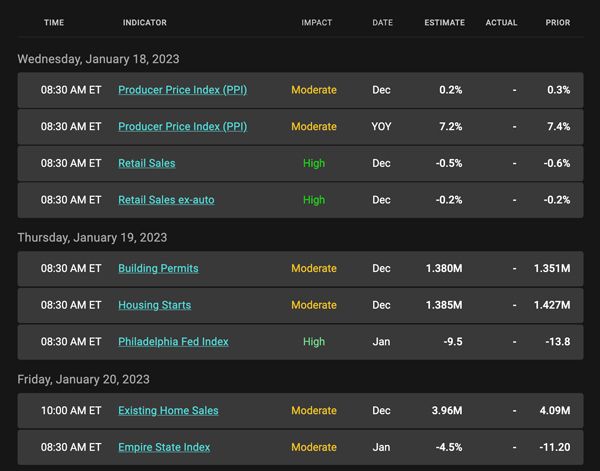

Next week is filled with economic reports that could move the markets, including Producer prices, housing, and retail sales. The good news is it feels like the markets are close to fully pricing in a .25% Fed rate hike in February, which could remove some volatility.

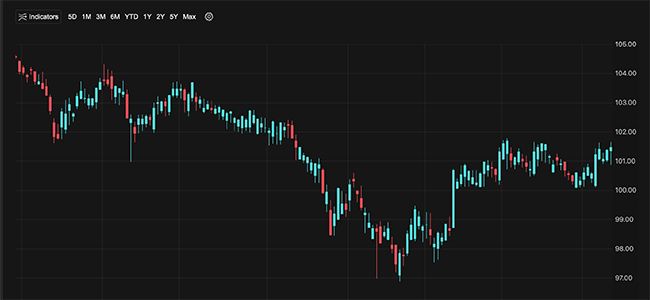

Mortgage Market Guide Candlestick Chart

Mortgage-backed security (MBS) prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower and vice versa.

MBS prices are right at a ceiling of resistance, which is limiting further improvement in rates. If MBS can move just slightly higher and above this nearby ceiling, rates will likely improve a bit more. The opposite is true.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, January 13, 2023)

Economic Calendar for the Week of January 16 - 20

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.