A Look Into The Markets

This past week there were only a few economic reports for markets to digest. As a result, rates remain stuck near key levels. Let's talk about what happened and look at next week's calendar as things heat up.

"Stuck in the middle with you" - Stealers Wheel

Volatility Continues

Interest rates have moved all over the place since the beginning of the year. The 10-year Note yield, as a proxy for mortgages, started 2024 at 3.85% and climbed to 4.18% in mid-January. Then we watched it decline sharply back to 3.85%, only to spike up to 4.18% in the last several days.

Volatility has mimicked the economic readings, which has shown a lot of good news and bad news. On top of that, the chance of a Fed rate cut in March has disappeared, eroding some of the optimism for lower rates coming sooner. This range that bonds are stuck in will be broken by a high impact news item, and last week didn't offer enough big news to drive bonds out of this range.

China Deflation

China, the world's second largest economy is having a rough go. Aside from real estate woes, and an overall economic malaise, they are now dealing with deflation…an outright decline in prices. On Thursday, it was reported that prices declined year-over-year by 0.8%. That sounds great right? Prices are moving lower. As the saying goes "Be careful what you wish for". Deflation is very harmful to an economy. It makes cash worth more and prices of real assets decline. For housing, it is awful, as people wait on the sidelines for prices to drop further before buying. Let's hope any whiffs of deflation that we may import from China doesn't grow into a larger issue.

Debt Remains a Headwind

Last week, the Treasury department sold over $100 billion worth of Treasuries, $42 Billion of which in 10-year Notes, the largest auction size in the history of our country for that security. This is a story to follow, as longer-term debt like 10-year Notes and 30-year bonds, carry more risk because of the time premium. We have seen investors demand higher interest rates to take the risk of purchasing longer term debt. If this story continues throughout the year as we continue to run deficits, it will be difficult for rates to meaningfully improve.

Fed Speak in Full Bloom

On the heels of last week's Fed meeting, Fed officials were out and about pouring cold water on the notion that the Fed will cut rates in March. In fact, most towed the same line and shared that a cut might not happen until the summer. This is yet another reason why long-term interest rates are stuck in a range. We entered 2024 with the Fed telling us they were going to cut rates three times, and the Fed Funds Futures pricing in as many as six or seven. Now it's clear that the Fed is only going to cut a few times based on some of the stronger than expected economic news of late.

Bottom line: In the short term, any improvement in interest rates may be fleeting as we look for clear signals in the next direction. If the 10-year Note yield moves above 4.20%, rates are heading higher. And if the 10-year yield moves beneath 3.85%, rates are going to move nicely lower.

Looking Ahead

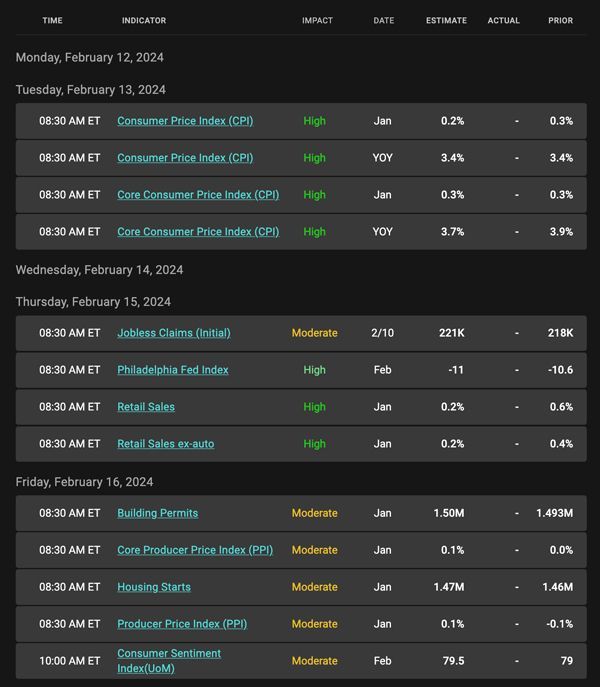

Next week we get the Consumer Price Index (CPI). Inflation has shown itself to be moving in the right direction. In fact, the Fed's favorite gauge of inflation recently was reported at 2.9%, the lowest in three years and within striking distance of their target of 2%. Nonetheless, rates have remained stubbornly high on fears that inflation may be re-accelerating. So, this week's CPI will have a big impact on what happens with rates.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 5.5% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

On the far-right side of the chart, you can see how prices are sliding lower from the best levels of the year.

Chart: Fannie Mae 30-Year 5.5% Coupon (Friday, February 9, 2024)

Economic Calendar for the Week of February 12 - 16

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.