A Look Into the Markets

This past week, the war between Israel and Hamas sparked a "safe-haven" trade into the U.S. bond market. Let's discuss what it all means and look into what economic reports can move the markets this coming week.

Safe Haven Trade

When uncertain geopolitical risks arise, like the Hamas attack on Israel, investment money around the globe, look for a safe haven, and that safe haven has always been the U.S. dollar and the U.S. bond market. It was no different this time, as the 10-year note dipped to 4.54%...the lowest level in a couple of weeks.

How long can the safe haven trade last, with money flowing into Treasuries, preventing interest rates from rising? No one knows. It depends on how long the conflict continues in Israel and Gaza, and whether it escalates or not. Besides, helping interest rates improve, it appears it has changed the outlook for the Federal Reserve.

"The recent rise in long-term U.S. Treasury yields, and tighter financial conditions more generally, could mean less need for the Federal Reserve to raise interest rates further”, Dallas Fed President Lorie Logan.

Just days after Friday's strong jobs report, which would've normally prompted Fed officials to offer statements like the need for more rate hikes, we have since heard the opposite in the quote above. This is a big departure from what Fed officials were saying a week ago, and the financial markets are now pricing a strong probability of the Fed no longer hikes rates.

What could derail the improvement in rates and possibly require the Fed to hike again? Oil and inflation. When Russia attacked Ukraine in February 2022, oil went from $90 to $130 a barrel in a very short time. So far, oil has remained in the mid $80 range per barrel and below recent highs.

Consumer Inflation Remains High

Last Thursday the Consumer Price Index was reported, and it showed inflation remains a problem. The Shelter and energy components of CPI made up most of the price increases. Should energy move higher in the weeks ahead, it could prompt the Fed to reconsider hiking rates.

Bottom line: Expect high volatility with news emerging from the Middle East, along with the threat of higher oil prices.

Looking Ahead

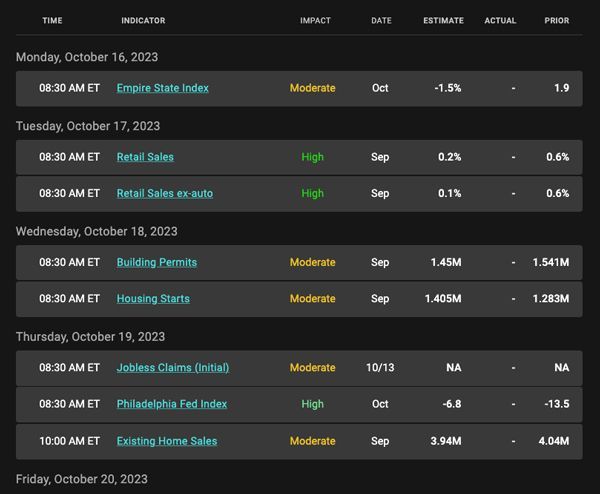

Expect the news out of Israel and the Gaza Strip to dominate the headlines and markets in the days and weeks ahead. The economic calendar here in the U.S. will be somewhat light. Wednesday's Building Permits and Housing Starts is likely to be a weak reading considering the increase in rates and energy.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.5% coupon, where currently closed loans are being packaged. As prices go higher, rates move lower, and vice versa.

On the far right side of the chart, you can see how prices are trying to stabilize at 2023 price lows. A failure to hold at these levels will likely cause home loan rates to rise to another level.

Chart: Fannie Mae 30-Year 6.5% Coupon (Friday, October 13, 2023)

Economic Calendar for the Week of October 16 - 20

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.