A Look Into The Markets

The Federal Reserve met this week and reaffirmed rate cuts are coming but, how many and why? Let's discuss what happened and look into the week ahead.

"Communication breakdown, it's always the same Havin' a nervous breakdown, a-drive me insane"...Communication Breakdown by Led Zeppelin

Mixed Fed Messages

On Wednesday, the Federal Reserve met and decided to once again pause and not cut rates. This was widely expected, as inflation has been reported higher than expected of late. It wasn't the lack of action which moved the markets, but the forecast The Fed provided in their statement which helped both stocks and rates improve.

Fed's Forecast

Every three months, the Federal Reserve issues their economic forecasts. This is where they adjust their outlook on the economy, unemployment, inflation, and the path for interest rates. So, what is the Fed thinking?

The Fed now sees economic growth stronger than expected, which is a good thing, and it removes the near-term threat of a recession.

They also believe unemployment will come in lower than previously forecasted and inflation will also come in higher than forecasted.

The head scratcher in all of this is that despite the Fed seeing stronger growth, less unemployment, and more inflation, they held their forecast to cut rates three times this year.

With just 6 Fed meetings remaining in 2024, it means rate cuts are coming soon. How soon? The financial markets are pricing the first rate cut in June with a current probability of near 75%. This will of course change as economic readings are reported.

Slowing the QT

In a measure that may help interest rates improve down the road, the Federal Reserve said they are going to start slowing their balance sheet reduction, quantitative tightening (QT), very soon. Part of the upward pressure on long-term interest rates the past couple of years has been QT. So, less QT, could be a good thing.

The Market Reaction

Interest rates improved modestly, and stocks hit all-time highs once again. You can see the chart of mortgage-backed securities below which highlights the nice price gains and rate declines this week.

4.35%

The 10-year Note moves up and down with mortgage rates and it is easy to follow. Watch 4.35%. If rates move above this level, they will be going higher still. The good news? As of press time, rates remain beneath that level.

Bottom line: Rates have improved this week and after the Fed's call for cuts, therefore we should expect lower rates ahead.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see prices rising, meaning lower rates.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, March 22, 2024)

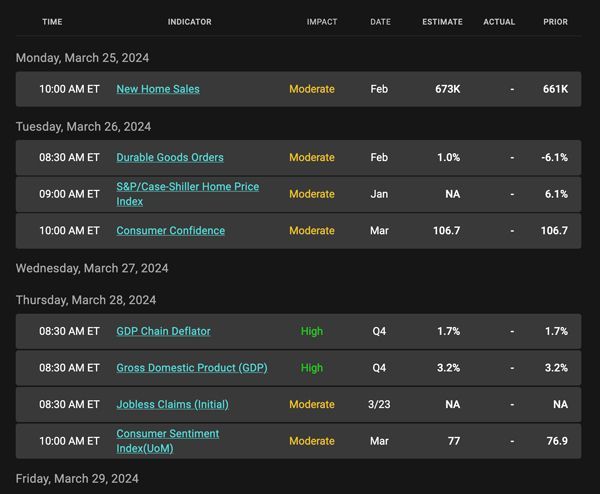

Economic Calendar for the Week of March 25 - 29

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.