A Look Into The Markets

A good week for rates as they ticked to the best levels in a month. Let's discuss where they are headed, why and what's next.

"It feels good, yeah. It feels good" – Feels Good by Tony! Toni! Tone!

Fed Says Higher for Longer – Mortgage Rates Improve

There was nothing stopping rates from improving this past week, not even Fed Chair Powell on Capitol Hill reiterating they are not cutting rates just yet.

The Fed "does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent." Jerome Powell, 3/6/24.

This quote highlighted the Fed's position that they are in no rush to cut rates until they are confident inflation is headed towards 2.00%.

Mortgage Purchase Applications up 11% on the Week

This positive headline from the Mortgage Bankers Association is good news but needs to be taken with a grain of salt as application volume is low and any move creates large percentage swings. Nonetheless, this number also didn't take into effect the full decline in rates from week to week. If you consider the "lag effect" or delay as to when consumers learn about the improvement in rates, it feels like even better days might be ahead for housing.

Labor Market Loosening

There were a couple of signs the labor market continues to loosen. First, the ADP Report, which shows private jobs created (versus government jobs) came in below expectations. Also, the JOLTS report, which shows how many "help wanted “signs or jobs that are available, came in below expectations.

The decline in jobs available is a welcome sign to the Fed, because if there are less jobs available, it lessens the need to pay more and thereby fuel inflation. Further loosening of the labor market will help pull forward Fed rate cuts.

Market Fed Cut Expectations

The Fed Funds Futures, which prices in the probability of rate cut/hike activity, is now pricing in the first rate cut in June at about 68%. It is important to note that the Fed Funds Futures have been very inaccurate in forecasting rate hike/cut activity. The only accurate source for Fed hikes has been the Fed and if they say they are coming later with the hike, that may very well happen. As the saying goes, "Don't fight the Fed".

Bottom line: Rates improved nicely this past week on the weaker labor market data and confirmation that the Fed will be cutting rates at some point. What's next? Read on...

Looking Ahead

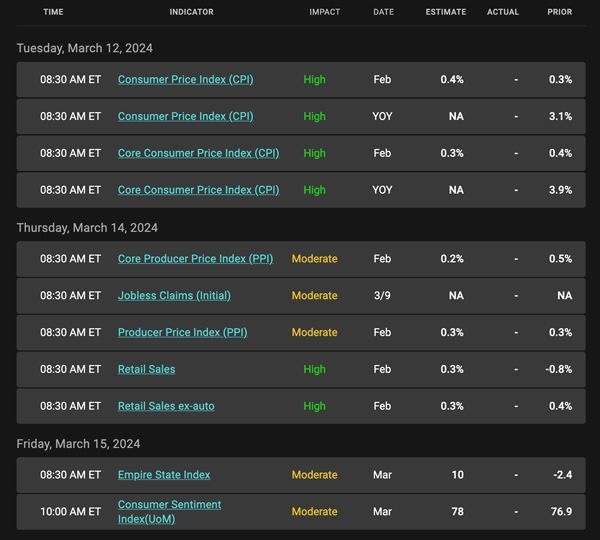

Next week it is about inflation once again. The Consumer Price Index and Producer Price Index will be released. If these reports come in with hotter than expected inflation, rates will struggle. The opposite is true. These reports may very well determine whether this relief in rates will continue to have legs.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

Note on the right side of the chart several consecutive Green Candles highlighting the price and rate improvement. Price needs to push higher from here to make this interest rate improvement sustainable.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, March 8, 2024)

Economic Calendar for the Week of March 11 - 15

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.