A Look Into The Markets

This past week interest rates ticked up to the highest level of the year, as the Minutes from the Fed's last meeting were released. Let's discuss what happened and look at the week ahead.

Minute by Minute - The Doobie Brothers

Fed Meeting Minutes Released

Last week's main event was the release of the Minutes from the January Fed meeting. Fed Chair Powell made it clear that a rate cut in March was not their "base case". Upon the Minutes being released, it became clear it was the same sentiment amongst most Fed members.

Most Fed members agreed they need to proceed carefully on cutting rates and not do it too soon as inflation remains above their intended 2% target.

Yet, at the same time, some Fed officials expressed concern about keeping rates too high for too long. This lack of consensus and mixed messaging highlights the uncertainty surrounding where inflation and the economy are headed, and when rate cuts are coming.

As always, the Fed reiterated they will be data-dependent and will rely on incoming inflation and economic readings to determine if and when to cut rates. The market is currently pricing in a rate cut this June, which is a lot different from a March cut priced in just one month ago.

So overall the Fed confirmed what we knew back in January - rate cuts are off the table for now and they need to see more disinflation for the Fed to move rates lower. But there was one note that could help long-term rates like mortgages in the future.

"Noting reductions in overnight reverse repo usage many officials said it would be appropriate to start in depth balance sheet reductions at next meeting." FOMC Minutes Feb 21 2024.

The Fed's balance sheet reduction is another form of tightening monetary policy, and it is a reason why long-term rates, especially mortgages, are higher. If the Fed starts to slow balance sheet reduction, it could lead to stabilization and possibly improvement in long-term rates.

Debt Everywhere

As mortgage and housing professionals, we must watch events around the globe. On Wednesday, during a day with not much news here outside the Fed Minutes, a German bond auction went off poorly and caused rates around the globe to rise.

Shortly thereafter, our Treasury Department sold $16 billion worth of 20-year bonds, and that auction also went off poorly… meaning investors needed to be compensated with more yield to buy the bonds. As those rates move higher, it causes mortgage rates to move higher as well.

LEI is BAD

The Conference Board's Leading Economic Indicator report showed the U.S. slowed quickly between December and January, highlighting the uncertainty around the strength of the economy. On one hand, we have strong labor market data, and on the other, we see numbers that suggest recession threats rising.

4.32%

The 10-year Note has a yield existence at 4.32%, which held yields from going higher the last week or so. If that level holds, it will keep long-term rates from moving higher. The opposite is true.

Bottom line: Uncertainty exists in the financial markets as to the strength of the economy and when the Fed will be able to cut rates. This means in the near term, any improvement in long-term rates may be short-lived. Upon clear data and direction, we will see further stabilization in interest rates.

Looking Ahead

Next week we get the critical Core Personal Consumption Expenditure Index (PCE). There is fear that this number will come in higher than expectations much like the recent CPI and PPI numbers. If it does, the bond market could have another rough time. However, if that reading were to come in below expectations, the bond market could celebrate. Why? The core PCE is the Fed's favored gauge of inflation.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see prices are at the lowest levels of the year, which means the highest rates of the year.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, February 23, 2024)

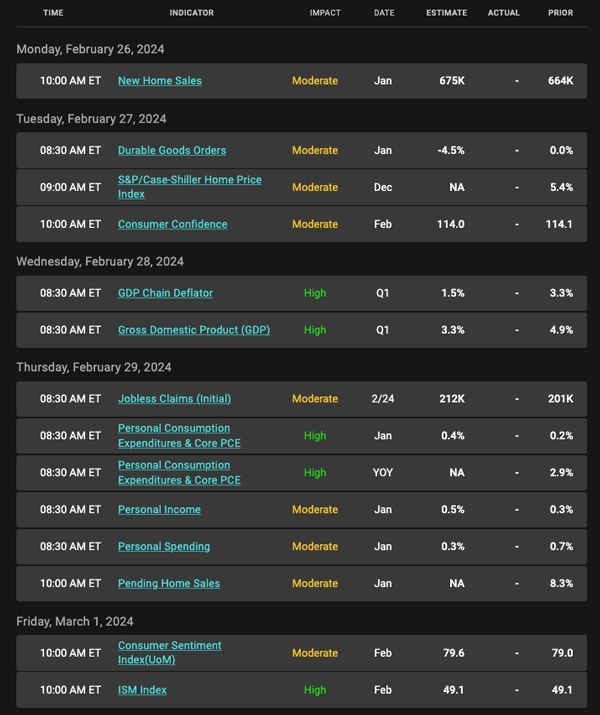

Economic Calendar for the Week of February 26 - March 1

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.