A Look Into The Markets

This past week home loan rates held steady after an important inflation reading was delivered and Federal Reserve Chair Jerome Powell testified on Capitol Hill.

Let's break down what happened and peek at next week's big items to watch.

"Then I look at you. And the world's alright with me" Lovely Day by Bill Withers.

June Inflation Reading "pretty good"

Last Thursday, the financial markets braced for the important June Consumer Price Index (CPI). The headline CPI, which includes food and energy prices, "decreased" by 0.1% during the month. This surprisingly low print helped lower the year-over-year rate to 3.0%, the lowest reading in one year.

The Core CPI, which excludes food and energy, was reported at a light 0.1% for the month, lowering the annual Core CPI to 3.3%, the slowest rate in three years.

Inflation does remain well above the Federal Reserve's target of 2.00%, but this was welcome news, especially on the heels of last month's tame reading and after we experienced higher-than-expected inflation readings at the beginning of the year.

It is worth noting that while this inflation reading is low, we must remind ourselves that CPI was 3% last June. Is inflation finally moving lower? Will this reading prompt the Fed to cut sooner? Right now, the chance of a Fed rate cut in September has spiked to 83%. And if we see more "pretty good" readings over the next month, we may very well get a rate cut in September.

Powell on Capitol Hill

This past week, Federal Reserve Chair Jerome Powell gave his semiannual testimony in front of Congress. As always, there was political grandstanding on both sides, but at the end of the day, Powell reiterated that they need to see more "pretty good" readings for the Fed to be comfortable in cutting rates. This comment, along with the recent "pretty good" CPI readings, does open the door for a September rate cut if the July CPI reading also comes in low.

The Federal Reserve is an independent body and does not typically comment on fiscal policy, which comes out of Congress and the White House. However, Mr. Powell did comment that while our current national debt can be managed, the trajectory of our new debt is unsustainable.

10-Year Note

The 10-year Note, which ebbs and flows with mortgage rates, is currently at 4.20%, and has remained beneath 4.36% for the past couple of weeks. The longer the 10-year Note can stay beneath 4.36%, the better the chances are that this level becomes a ceiling of yield resistance keeping rates from moving higher. Over the last nine months the 10-year Note has made lower rate peaks going from 5%, to 4.74%, to 4.50%, and now to 4.36%. If the 10-year Note can push beneath 4.20%, the next stop will be 4.09% and ultimately 4%.

Bottom line: Inflation has come down in recent months but has simply offset the spike seen earlier in the year. With inflation now at levels seen about one year ago, we are now watching to see if inflation is indeed on a path to move sustainably towards 2%, thereby, bringing forward a Fed rate cut.

Looking Ahead

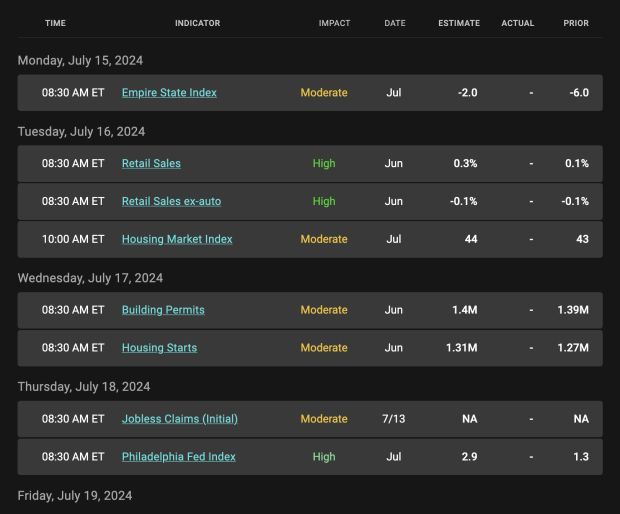

Next week ushers in a lot of important economic readings like Retail Sales, Empire Manufacturing, Housing Permits, and Starts. On the heels of low CPI reading, it will be interesting to hear what Fed officials say in their speeches regarding the rate cuts. The Empire and Philly Fed Indexes will provide readings on local manufacturing. These readings have been attracting elevating concerns that a slowing economy could lead to recession.

Mortgage Market Guide Candlestick Chart

Mortgage bond prices determine home loan rates. The chart below is a one-year view of the Fannie Mae 30-year 6.0% coupon, where currently closed loans are being packaged. As prices move higher, rates decline, and vice versa.

If you look at the right side of the chart, you can see how prices have busted above a sideways range and match the best levels since February.

Chart: Fannie Mae 30-Year 6.0% Coupon (Friday, July 12th, 2024)

Economic Calendar for the Week of July 15-19

The material contained in this newsletter has been prepared by an independent third-party provider. The content is provided for use by real estate, financial services and other professionals only and is not intended for consumer distribution. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, there is no guarantee it is without errors.

As your mortgage professional, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

Mortgage Market Guide, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Market Guide, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.